There are plenty of homes for sale in St. Charles County and St. Louis County. There are some great deals, but will they get better? Just because a home drops in price doesn’t necessarily mean that the house will cost less.

Interest rates are key in determining the total cost of the house, and as a result need to be factored in as a major consideration in whether to buy a St. Charles County or St. Louis County home now — or wait. The following article does a great job of explaining this!

by Pat Zaby May 23, 2011 15:59 PM

Uncertainty as to whether prices will continue to fall has to be one of the most common causes of buyer procrastination. Paying too much wouldn’t be a smart thing but price isn’t the only factor to consider. Interest rates have as much effect on housing costs as price.

A small increase in mortgage interest rates can offset a significant drop in home prices. If the price of the home were to come down by 5% but the interest rates were to go up by .5%, the payments might be close to the same.

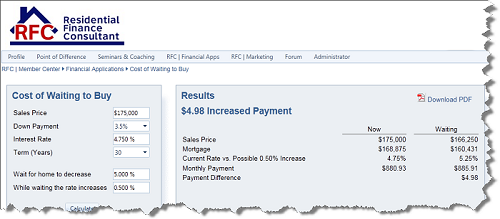

In the example below, if the price of $175,000 home went down 5% but the interest rate went from 4.75% to 5.25%, the payments would actually be $4.98 more at the cheaper price. If while the buyer was waiting for the home to decrease 5% and the interest rate increased by 1%, the payments would actually go up by $55.30.

Then, of course, there is always the possibility that the price of the home doesn’t go down but the rate does go up by 1%. The payments would be $104.58 more per month, each and every month for as long as you have the mortgage on the home.

A Residential Finance Consultant can provide solid information that will help you make better buying decisions. A home is a place to feel safe and secure, to raise your family, share with your friends and an investment. It’s an investment in your marriage, your family and your future. You owe it to yourself to check out the real numbers in your market because every market is different.

A top real estate agent and mortgage banker can help you make an informed decision about whether it is the right time to buy in St. Charles County and St. Louis County. My team specializes in St. Charles and St. Louis County. If you are considering buying a home, please contact Sandra Meranda and I’ll get you moving!

Spring has sprung in St. Charles and St. Louis! This is the time of year for buying and selling real estate. There are large numbers of homes at below-market prices & the move-up market has been energized for the Spring. Interest rates are hovering around 5% & home sale numbers have been increasing every month, it is a great time to list your home also.

Spring has sprung in St. Charles and St. Louis! This is the time of year for buying and selling real estate. There are large numbers of homes at below-market prices & the move-up market has been energized for the Spring. Interest rates are hovering around 5% & home sale numbers have been increasing every month, it is a great time to list your home also.

CO DetectorWhen purchasing a CO alarm, look for an Underwriters Laboratories (UL) listing on the label. Follow manufacturer installation and maintenance guidelines. Replace batteries at least annually and replace older units, as recommended by the manufacturer (typically when 5 to 7 years old). Also, when considering CO detector placement, don’t forget the need for regular testing of smoke/fire detectors and fire extinguishers.

CO DetectorWhen purchasing a CO alarm, look for an Underwriters Laboratories (UL) listing on the label. Follow manufacturer installation and maintenance guidelines. Replace batteries at least annually and replace older units, as recommended by the manufacturer (typically when 5 to 7 years old). Also, when considering CO detector placement, don’t forget the need for regular testing of smoke/fire detectors and fire extinguishers.